Ehsaas Nojawan Program

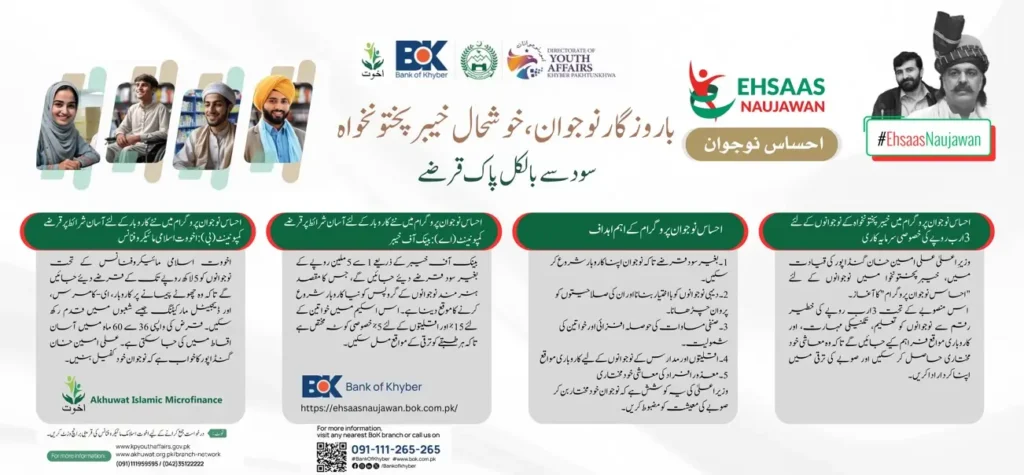

Khyber Pakhtunkhwa Chief Minister Ali Amin Gandapur has officially launched the Ehsaas Nojawa Program. Through this program, loans will be provided to young people to start small and large businesses. In these loans, a loan of one lakh to five lakh rupees will be provided for small businesses

Loans between 10 lakhs and 50 lakhs will be provided for large businesses.

The objective of the Ehsaas Naujawan Programme is to remove the financial barriers that prevent youth from starting their own business so that the best business opportunities can be created for youth across the province. Recognizing the immense potential of our youth, these programs are constrained by limited financial resources. The loans will be disbursed through Ikhwat Islami Microfinance Institute and Bank of Khyber.

Maryam Nawaz Loan Scheme 2024 Online Apply For 15 Lakh Loan

Small loans ranging from one lakh to five lakhs will be given through Akhuwar Islamic Microfinance, while large loans will be given through the Bank of Khyber. These loans will be given to you without interest which you can repay easily for a period of eight years. You can apply online to get a loan through the Bank of Khyber.

The complete procedure of Ehsaas Young Program Online Registration will be explained in this article. While applying for a small loan, you have to go to the nearest Islamic Brotherhood Mayo Karo Finance Institute. All the details are given in this article.

Utility Store Subsidy Check Online Through 8171 Web Portal

Loan Distribution Details

The Ehsaas Nojawan Program offers two main types of loans based on the size of the business venture:

- Small Business Loans: For young people starting small ventures, loans range from PKR 100,000 to PKR 500,000, provided through the Akhuwat Islamic Microfinance Institute.

- Large Business Loans: For larger ventures, loans range from PKR 1 million to PKR 5 million and are distributed by the Bank of Khyber.

This structure ensures that both small and large businesses have access to the funds they need, without the burden of interest or collateral, making entrepreneurship accessible to a wider audience.

Benazir Taleemi Wazaif Phase 2 Payment Update and Check By CNIC

Interest-Free and Collateral-Free Loans

A unique aspect of the Ehsaas Naujawan Programme is that it offers interest-free loans, helping reduce the financial stress often associated with borrowing. Additionally, no collateral is required to access these loans, opening doors for youth who might otherwise struggle to secure funding through traditional methods. This feature ensures that even those from less privileged backgrounds can pursue their business dreams without financial anxiety.

How to Apply for Ehsaas Nojawan Program Loans

The application process for the Ehsaas Nojawan Program varies based on the type of loan. Below is a step-by-step guide for each category:

Ehsaas Nojawan Program Registration

Small business loans are available through the Akhuwat Islamic Microfinance Institute. Here’s how to apply:

- Visit the Nearest Akhuwat Branch: Applicants must go to an Akhuwat branch. You can locate the nearest branch using the Akhuwat branch network page: Akhuwat Branch Locator.

- Fill Out the Application: Complete the loan application form with the required details.

- Submit Documents: Provide all necessary documents, including proof of identity, residency, and a business plan.

- Application Review: Akhuwat will review your application, and once approved, funds will be disbursed.

Benazir Kafaalat Phase 2 Payment Schedule, Districts and Bank Cluster Details

Ehsaas Nojawan Program KPK Online Registration

Large loans for expanded business ventures are available through the Bank of Khyber. To apply:

- Online Application: Go to the official Ehsaas Nojawan Program portal hosted by the Bank of Khyber: Bank of Khyber Ehsaas Nojawan Portal.

- Fill Out Online Form: Complete the online application form with accurate details.

- Upload Required Documents: Upload necessary documents, such as a valid CNIC, business plan, and proof of residence.

- Application Processing: The Bank of Khyber will review applications, and once approved, the loan will be disbursed directly to your account.

Dhee Rani Program Registration Last Date Extended to 15 November

Loan Repayment Terms

Repayment terms for the Ehsaas Nojawan Program are designed to be flexible, giving youth the time they need to establish their businesses:

- Bank of Khyber Loans: Can be repaid over up to eight years, ensuring manageable installments.

- Akhuwat Islamic Microfinance Loans: Offers repayment terms ranging from 36 to 60 months.

The program’s repayment flexibility allows young entrepreneurs to build their businesses before they need to start repaying, ensuring a supportive, growth-oriented approach.

Important Update For Selected Candidates in Punjab Bike Scheme

Equitable Allocation Across KPK

To ensure fair access across the province, funds are distributed proportionally to each district based on its population. This method guarantees that youth from all regions, including remote areas, can benefit from the program and have an equal chance to access business loans.

Impact of the Ehsaas Nojawan Program

The Ehsaas Nojawan Program is more than just a financial support scheme; it’s a transformative initiative with long-term socio-economic impacts:

- Youth Empowerment: By providing financial assistance, the program empowers young individuals to become self-reliant and financially stable.

- Economic Development: Youth-led businesses contribute to the local economy, creating a cycle of growth and opportunity.

- Job Creation: Supporting new businesses helps generate employment opportunities within communities.

Important Guidelines for Farmers Selected in Green Tractor Scheme

Conclusion

The Ehsaas Nojawan Program is a game-changer for young people in Khyber Pakhtunkhwa. With interest-free, collateral-free loans and flexible repayment terms, this initiative by the KPK government is breaking down barriers and providing youth with the resources they need to succeed. If you are a young entrepreneur looking to start or grow a business, now is the time to take advantage of this opportunity.

To get started, simply visit the nearest Akhuwat branch for small business loans or apply online through the Bank of Khyber portal for larger ventures. The Ehsaas Nojawan Program is here to turn your dreams into reality, so take the first step today and help shape a prosperous future for yourself and your province.

8171 Benazir Kafalat Program Payment Check Online Phase 2